What Is Going on with Crypto?

The Mad Brief #02

PS: Sign up for free on our platform to receive these weekly briefs in PDF format, delivered straight to your inbox. Plus, gain access to exclusive content and special promotions when you subscribe!

Welcome to THE MAD BRIEF

Crypto investors are bewildered, frustrated, and anxious—and who can blame them, right?

They were promised the mother of all cycles, yet reality has fallen far short of expectations. The once-dominant cycle narrative has unraveled, leaving us adrift in uncharted territory.

Which is something I have been saying for a while now at The Mad King: This cycle is different!

I've been monitoring this cycle closely. While I do have some crypto exposure, I’ve kept my positioning low-key this time—a lesson well learned from the previous cycle.

Since I have skin in the game, I’d love for things to unfold as expected. But this cycle has been one of the most painful, and I refuse to believe narratives just because they align with my interests.

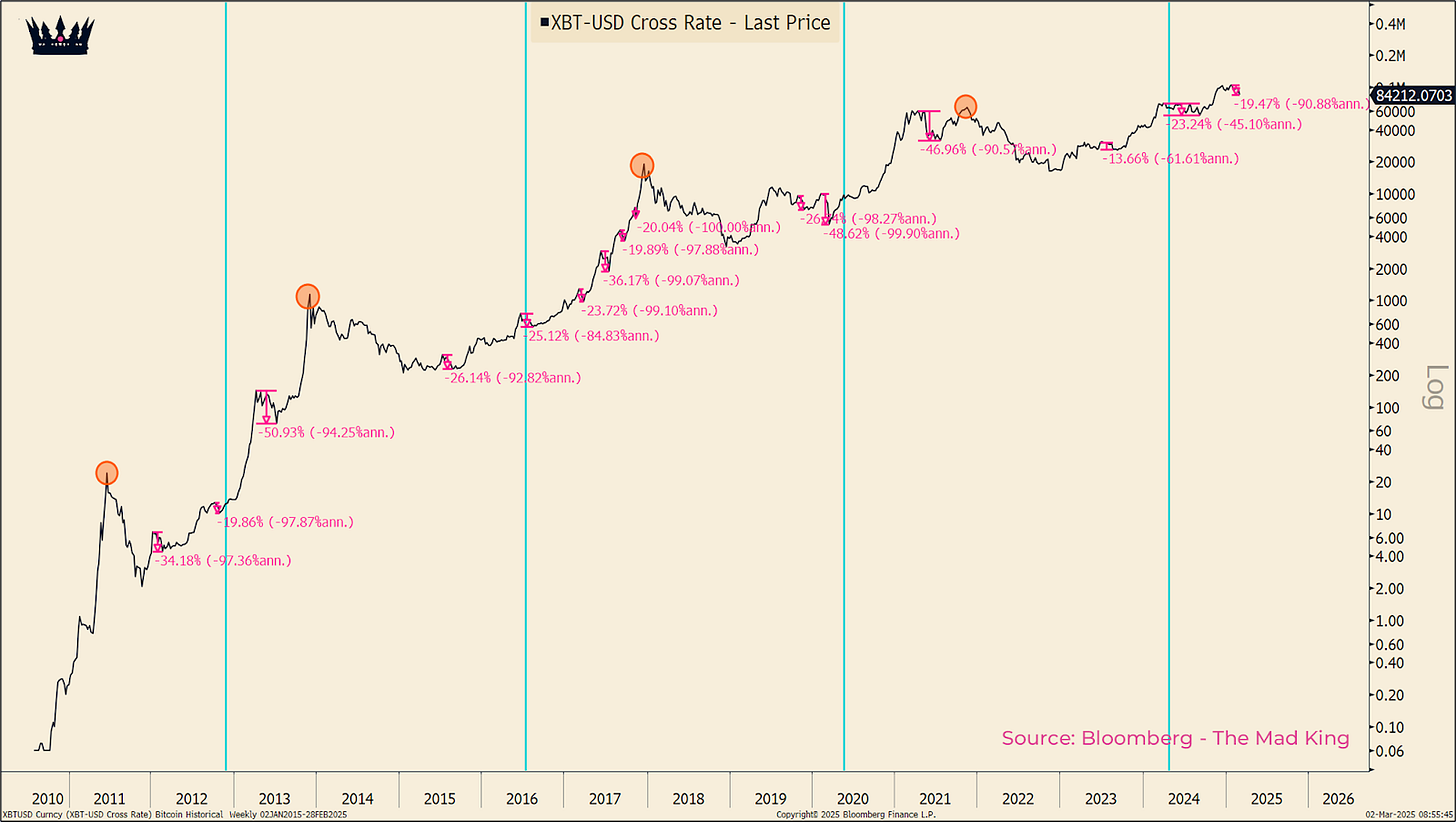

Nevertheless, Bitcoin's current behavior is anything but "normal" by the standards of previous cycles. While negative yearly growth is possible during an up cycle post-halving, it historically required an extreme event like COVID to trigger it.

And right now we are close to seeing Bitcoin growth go negative.

Which is astonishing, considering that the setup of the current cycle is as good as it can get:

Pro-cryto SEC

Pro-crypto US administration

Strategic reserves

ETFs

Regulatory framework development

The reason? Misleading expectations.

Looking back, we’ve had three clear crypto cycles; and in hindsight, they all seem obvious… and were very volatile…

That led many to believe this time would play out the same way. People have clung to their preferred narratives—halving, liquidity, or whatever fits their bias—to justify their predictions.

The problem is that too many expectations were built on hype, FOMO-driven content, and rigid frameworks that didn’t account for market realities.

So far, this cycle has been chaotic—arguably the grifting cycle—with an unprecedented amount of liquidity extraction driven by the meme coin frenzy.

Yet, despite all the scams, drama, and record-breaking hacks, the industry has proven remarkably resilient. It hasn’t collapsed—in fact, it’s holding strong. Therefore, there is much more than price action that matters in the long term.

It’s funny how this correction feels like the end of the world for some, even though it’s completely normal within a bull cycle.

If you're in crypto for the potential outsized gains, you have to be comfortable with the volatility—it’s just part of the game.

That being said, too many people relied on limited frameworks this cycle mainly repeating what we have seen before..

#001 - Liquidity

I discussed liquidity in last week’s issue, and while the liquidity cycle has remained consistent every four years, it's essential to consider the unique context surrounding each cycle.

Yes, global liquidity is beneficial to Bitcoin growth…

But there's more to it. In previous cycles, money supply and central bank balance sheets moved in sync, but this time they are completely out of alignment.

This means that the widely beloved chart below, often cited to justify the return of liquidity, may not be as reliable as many believe. In the absence of real liquidity injections, its movement is driven by FX fluctuations—the current bounce isn’t new liquidity but rather the result of a rapidly weakening dollar.

Which means that the dollar is much more important to track, for now…

If central banks step in decisively, then relying on global money supply as an indicator could make sense. Until then, it doesn’t.

#002 - US Bitcoin Strategic Reserve

Expectations were high for the bitcoin strategic reserve, but so far, the results have been underwhelming. This disappointment largely stems from the crypto industry's sense of entitlement—when things don’t unfold exactly as they expect, they throw a tantrum like a spoiled child.

That said, the US is making steady progress.

While the impact may not be immediate, the steps being taken are laying the foundation for something far more sustainable. The pieces are coming together:

Executive order signed – The strategic reserves EO has set the framework in motion.

Regulatory green light – US regulators have cleared the path for banks to engage with crypto.

.Stablecoin adoption – US banks are actively considering launching their own stablecoin.

Global reserve strategy – Scott Bessent just announced plans to use stablecoins to maintain the US dollar’s dominance as the world's reserve currency.

These are critical milestones that, while not driving prices higher overnight, are shaping the long-term infrastructure for crypto’s integration into the financial system. Many other countries are likely to follow the US's lead—it’s just a matter of time.

I still believe Bitcoin will finish the year higher, but the road ahead won’t be smooth. The macro environment remains challenging, and those who succeed will be the ones prepared and willing to navigate the storm.

For now, set aside everything you thought you knew—the cycle isn’t over, altcoin season will take a new shape, and we’re entering uncharted territory.

Rest assured, Wall Street isn’t adopting crypto for small gains—everything is gradually falling into place.

#003 - A Painful Consolidation

In terms of price action, we're currently experiencing a correction similar to what we saw last year following the ETF launch and halving. However, this time, the decline is much sharper, which might give the impression that the cycle has ended. On a positive note, the recent bounce at $76,600 has established a new ascending channel to monitor, which could mean that the local bottom is in!

If altcoins don’t outpace Bitcoin in the coming weeks, we’re likely to see only a handful of them rally—so don’t expect the usual alt season and choose carefully.

Conclusion

This cycle is truly different, and expectations have been shaped for the wrong reasons. That said, while the current phase of this rally feels painful, we haven’t reached the end of it yet.

It’s crucial to reset expectations, set more realistic goals, and—most importantly—be willing to challenge your own biases and expand your knowledge.

Avoid limiting yourself to content that simply reinforces your position—especially if you're in the red. Seek diverse perspectives to challenge your assumptions and refine your strategy.

Looking back at previous cycles, many expected history to repeat itself.

But let’s be realistic—when too many people anticipate the same outcome, the market is unlikely to follow that script—that would be too easy.

The first phase of this cycle was driven by real structural shifts, such as ETFs, but was quickly followed by a chaotic meme-driven frenzy that left many exhausted.

The next phase will be more serious, centered around real projects delivering genuine utility and tangible yields. This is exactly what Wall Street will be looking for as a way to maximize its crypto exposure.

That’s why I believe DeFi 2.0 will be a major force. To me, this is precisely what the evolving regulatory framework is setting the stage for—and it’s coming sooner than many expect.

Don’t give up just yet, we never know…

Stay sharp. Stay curious. See you next week! 🚀

Mainstream adoption into the financial system, particularly the options market, completely changes the price dynamics. CAGRs should slow substantially.