Welcome to THE MAD BRIEF

This isn’t just another newsletter. It’s a filter for the chaos—a weekly signal in a world full of noise.

Every week, I’ll bring you something valuable, thought-provoking, and real—insights that cut across macro, technology, crypto, and anything else that moves the needle. Nothing is off-limits, because in today’s world, it shouldn't be.

We live in an era where attention is hijacked and thinking takes a backseat.

Workloads are heavier. Distractions are endless. Information overload is the default.

The result? People react, but they don’t reflect.

That’s where The Mad Brief comes in.

In just 10 minutes a week, it will challenge your perspective, sharpen your understanding, and, at times, confirm your instincts.

The goal isn’t to be right all the time—it’s to help you think better.

Because in a world drowning in opinions, clear thinking is an unfair advantage.

Spend 10 minutes with me each week, and I’ll help you build that edge.

I’ll be there every Thursday—hope you can too!

Remi

PS: Sign up for free on our platform to receive these weekly briefs in PDF format, delivered straight to your inbox. Plus, gain access to exclusive content and special promotions when you subscribe!

For this first edition, I’ll dive into the liquidity narrative—a topic I explored in depth in the latest issue of The Mad King: Over The Top.

There are many ways to estimate liquidity flowing into the system at any given moment, and to be honest, none of them are infallible—despite what their creators might claim.

Ultimately, all these models are only as good as the assumptions they rely on.

For me, a simple yet effective way to gauge global liquidity is by combining central bank balance sheets and money supply.

This approach captures major liquidity drivers, provides valuable macro and market insights, and can help identify key turning points.

The simplicity of this formula is what makes it so appealing and explains its widespread use. However, understanding its limitations is crucial for applying it effectively within any framework.

This model overlooks private credit creation, is highly sensitive to FX fluctuations, and disregards money velocity—an essential factor in fast-moving markets.

In my opinion, despite these weaknesses it is still a decent proxy to use in a bigger framework.

More than ever, global markets are driven by liquidity—a consequence of central banks repeatedly using liquidity injections as a solution since 2008.

But with no major disruptions since 2020, markets have been deprived of central bank liquidity and have been running on fumes for the past 3–4 years, sustained only by the sheer size of the 2020 liquidity injection.

When you combine central bank balance sheets and money supply, liquidity becomes fairly predictable.

Unless a black swan event with an impact similar to COVID occurs, I wouldn’t expect more than a few percentage points of global growth.

And even then, it would take a true emergency to trigger significant liquidity expansion.

Yes, the money supply is currently growing in the G4…

But when you create an index using money supply data and rebase it to exclude the FX effect, it becomes clear that money supply growth remains on an exponential trajectory set a long time ago—nothing new here…

If we accept that the COVID response was an anomaly, then it's clear liquidity growth is slowing—a natural outcome given the nominal levels already reached. This makes it highly unlikely that we’ll see growth exceeding 7%, unless something very bad happens—and I mean, like, 2008 or 2020 bad.

With Japan out of the equation, liquidity is now expected to come from China. However, despite widespread anticipation since last year, China has yet to deliver anything significant. For now, the PBoC is conducting business as usual…

And Chinese money supply growth is trending lower…

However, we can expect the Chinese government to step in at some point, because financial institution liquidity remains critically tight by Chinese standards.

The same goes for shadow banking…

Even so, this time around China is unlikely to repeat the 2008 trick that led to a huge commodity cycle, simply because too many Chinese real estate owners are currently underwater. Fool me once, shame on you; fool me twice…

If—and that’s a big if—China were to launch a new wave of stimulus, it would likely be more limited than previous ones. Additionally, it would almost certainly come with capital restrictions to ensure the liquidity remains within the Chinese economy rather than being siphoned off, by the US, for example.

Aside from the Fed, the ECB is the only remaining contender for a liquidity injection.

But rates are too high for now, and there is no emergency…

That leaves only the US; and given DOGE’s latest actions, I doubt we’ll see a liquidity injection anytime soon.

This is the moment to rein in spending before considering anything else. That said, Musk’s recent idea of sending a $5,000 check to US taxpayers—financed by savings from DOGE—would effectively act as a stimulus.

As I’ve mentioned before, if they manage to cut waste, fraud, and excessive spending, they could redirect those funds into initiatives like the $5,000 check without adding further strain to the national debt.

Obviously, such actions will have consequences—inflation being the first that comes to mind.

Nevertheless, my point remains: Liquidity cannot and will not return in significant size unless a crisis demands it.

At present, central banks are either constrained in their options or see no urgent need to intervene.

Unlike many others, I see the liquidity narrative as just that—a narrative—used to rationalize market predictions and direction.

One often-overlooked component of liquidity is demographics—a factor that, unlike markets, is highly predictable.

A growing population generally increases economic activity, which can raise the demand for liquidity.

However, money supply growth is primarily driven by central bank policies, credit expansion, and money velocity, while demographics play an important, yet indirect, role.

Still, this chart—which has tracked the global demographic curve for 20 years—suggests global money supply could nearly double to $200 trillion by 2040!

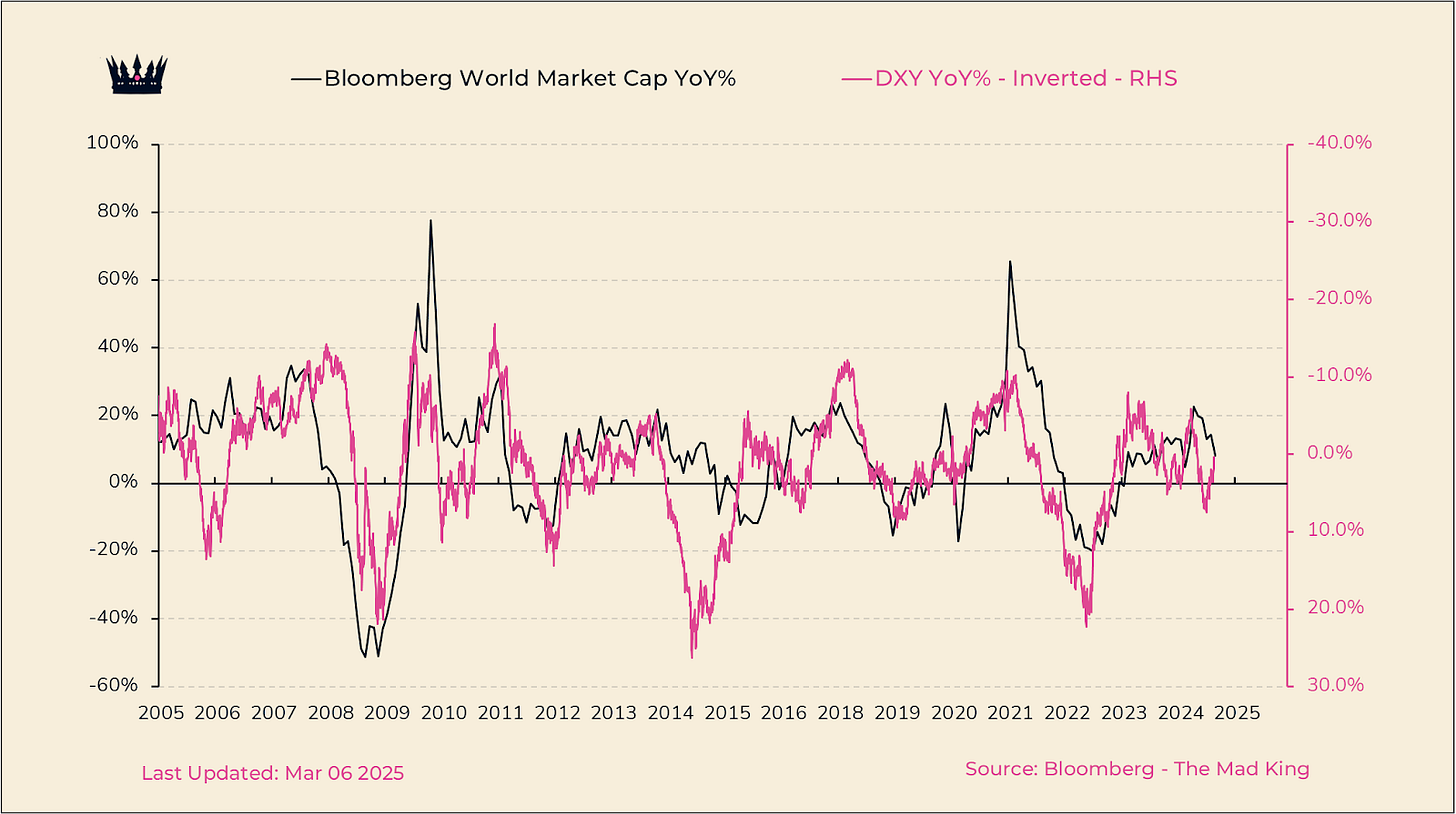

I’ve seen liquidity narratives come and go; yet time and time again, King Dollar dictates the game—it always has, and likely always will.

A weakening dollar positively impacts global liquidity growth; and right now, that’s the key factor at play to move the needle since central banks are tightening.

In the absence of a significant liquidity injection, as seen over the past 12 years, dollar momentum remains the most obvious financial tool to attempt to drive growth.

Since 2019, the dollar is leading global market growth by roughly 30 days (although the correlation is only 5 years old).

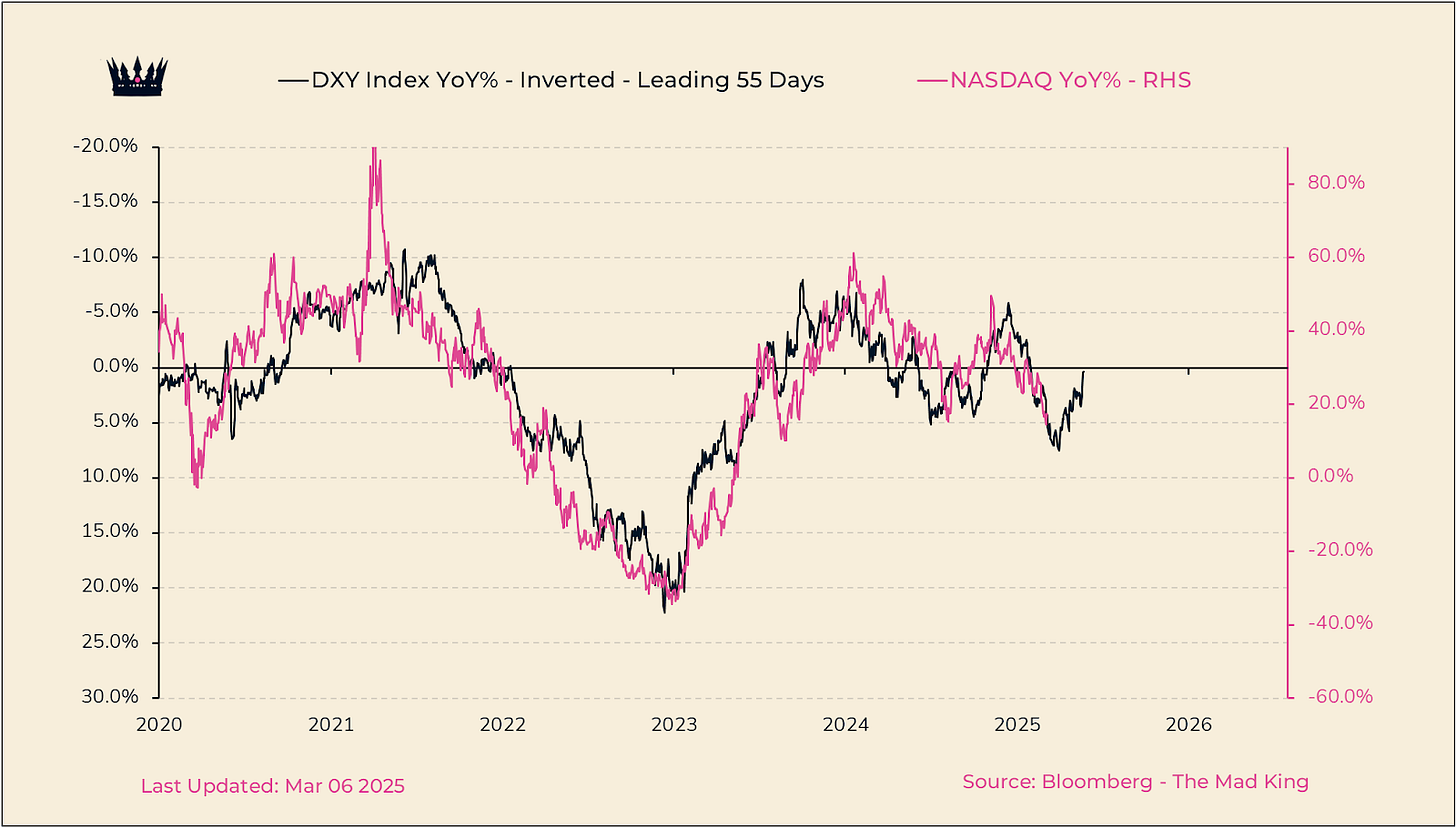

While it leads NASDAQ growth by 55 days…

The current movement in the dollar suggests a strong Q2 for the stock market.

But also for Bitcoin, i.e. the crypto market…

I know people love to use this chart to justify a potential crypto rally. However, its short timeframe makes it far less reliable—even if global liquidity aligns with Bitcoin over longer periods. But more is needed to justify Bitcoin cycles.

The last three Bitcoin cycles had two key components that made them real. First, each began with a weakening dollar before entering its exponential rise.

Secondly, global liquidity was strong leading into each rally and kept growing strongly during the ramp-up (orange circles), further contributing to dollar weakness.

This time, global liquidity growth entering this cycle has been weaker than usual and is unlikely to accelerate—barring any unforeseen events.

Conclusion – The Illusion of Liquidity

Liquidity narratives come and go, but one truth remains—King Dollar dictates the game.

While markets obsess over central bank interventions, the real driver of liquidity today isn’t policy; it’s perception.

In the absence of crisis-level injections, global liquidity is constrained, not expanding.

The dollar’s trajectory, not central banks, is the clearest signal of what’s next.

If you’re betting on global-growth, liquidity-driven rallies, ask yourself: Are you chasing reality or just the illusion of it?

Because in this cycle, the real edge isn’t just seeing the liquidity—it’s knowing when it actually matters.

And this time, my friends, the dollar will have to carry the narrative on its own... at least for now.

Stay sharp. Stay curious. See you next week!