“The poll that matters is the one that happens on Election Day.”

Heather Wilson

…

Election Year

The US is potentially poised for a rerun of the 2020 presidential contest, featuring Trump and Biden once again.

The 2020 election was marked by significant controversy, and expectations are that the 2024 race could follow a similar path.

A notable change, however, is Trump's current lead in key swing states.

The turnaround in Trump's poll numbers compared to a year ago has been remarkable.

No matter which poll you take…

While acknowledging that early polls may not be predictive of the final election outcome, they do offer a glimpse into the prevailing public mood. The recent Argentine elections might have given us some clues already. Before the US election, two other key elections will take place, first in Taiwan in less than a week, then in Europe in June.

The economic landscape and asset performance in the year leading up to the election are likely to significantly influence the election's outcome.

A looming recession could complicate matters, potentially diminishing President Biden's re-election prospects.

Conversely, if the Federal Reserve manages to achieve a 'soft landing' for the economy, this could enhance Biden's chances. By soft landing I mean avoiding a recession (even a mild one) at all costs .

The strength of the US economy is a contentious issue, as many people express concerns over reduced purchasing power.

These economic factors, particularly if the Federal Reserve cuts rates prematurely, leading to a resurgence in inflation, could play a crucial role in shaping voter decisions in the upcoming election.

Presidents often celebrate the stock market's performance during their tenure as a personal achievement, despite the market generally being indifferent to political affiliations.

Since 1950, only two US presidents didn't end their terms with stocks higher than when they took office: Nixon and G.W. Bush. (But both had an ATH during their terms, as well as two recessions each; and both were Republicans.)

Additionally, it's worth observing that a majority of recessions tend to occur during the administrations of Republican presidents.

This phenomenon can be seen either as a reflection of their individual policy failures or as consequences stemming from the actions of their predecessors.

If a recession was to kick in before the election, Biden could become the third president and the first Democrat to join the list.

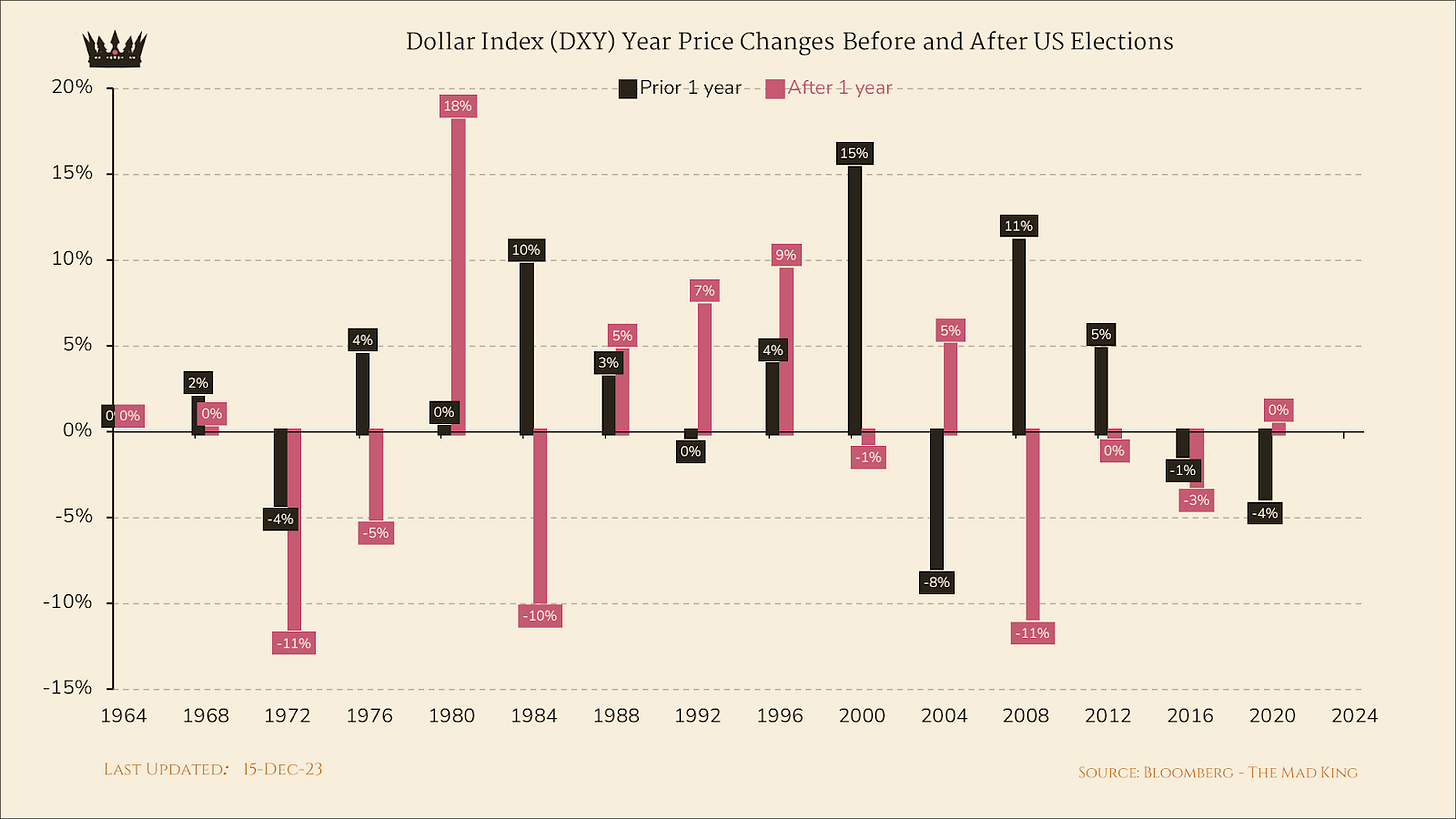

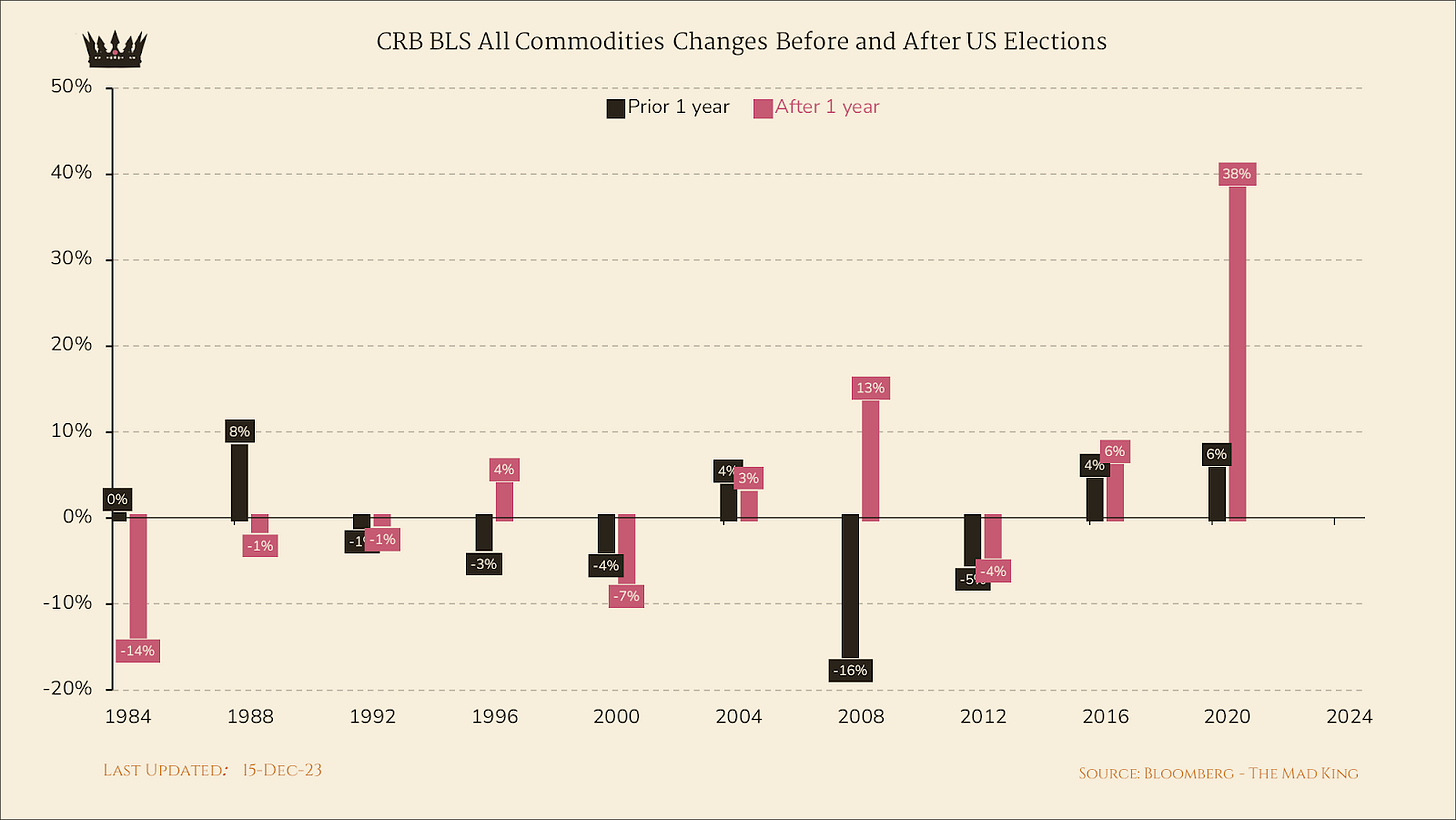

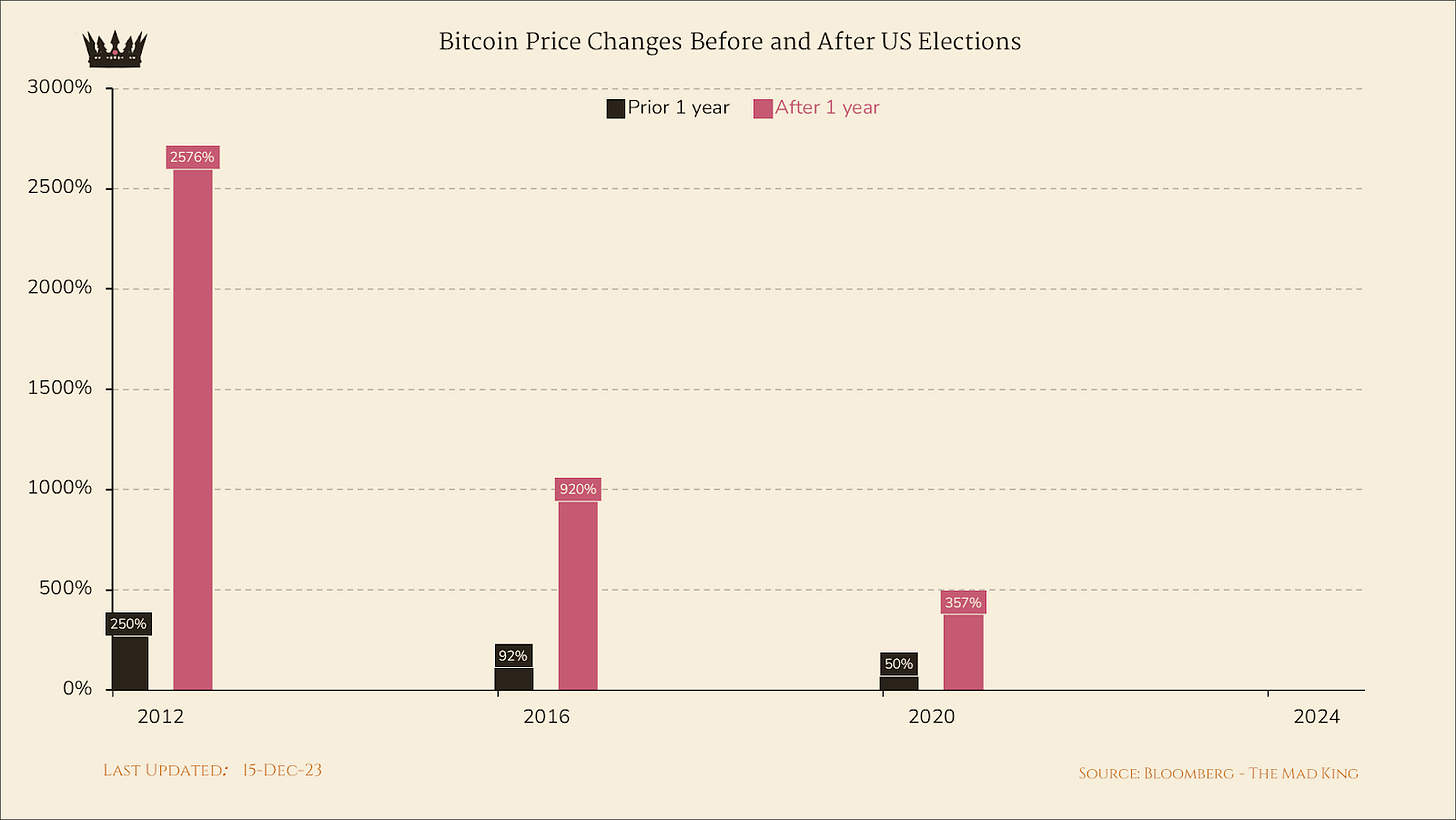

For a bit of entertainment, let's look at the performance of various assets and economic data before and after presidential elections since 1964.

Although none of this data can be used to predict asset prices, there are definitely some interesting patterns.

Except for 2008, since 1964 the S&P 500 ALWAYS rallied going into the elections.

Ditto for the NASDAQ…

Interestingly, small caps, represented by the Russell 2000, are slightly different…

Crude oil declines more often than not…

The roadmap for this is simple: Higher stock prices and lower oil prices are excellent marketing tools to demonstrate how well the economy is doing during your administration.

But this time around, a strong dollar could derail everything and bring a recession earlier than wanted…

Gold is everything… or nothing…

Bonds often rally (i.e. yields decline) ahead of an election… but also ahead of a recession!

US CPI always goes up, no matter what…

Ditto for the US public debt…

Industrial production used to always go up before globalisation became a thing…

Commodities can go either way, although we know they have remained elevated since Covid…

They are currently trending lower, therefore we can expect them to contract going into the election.

Bitcoin may go up, although presidential elections always fall on a halving year (which makes the price boost totally unrelated to the presidential election). he largest growth usually comes the year after the election.

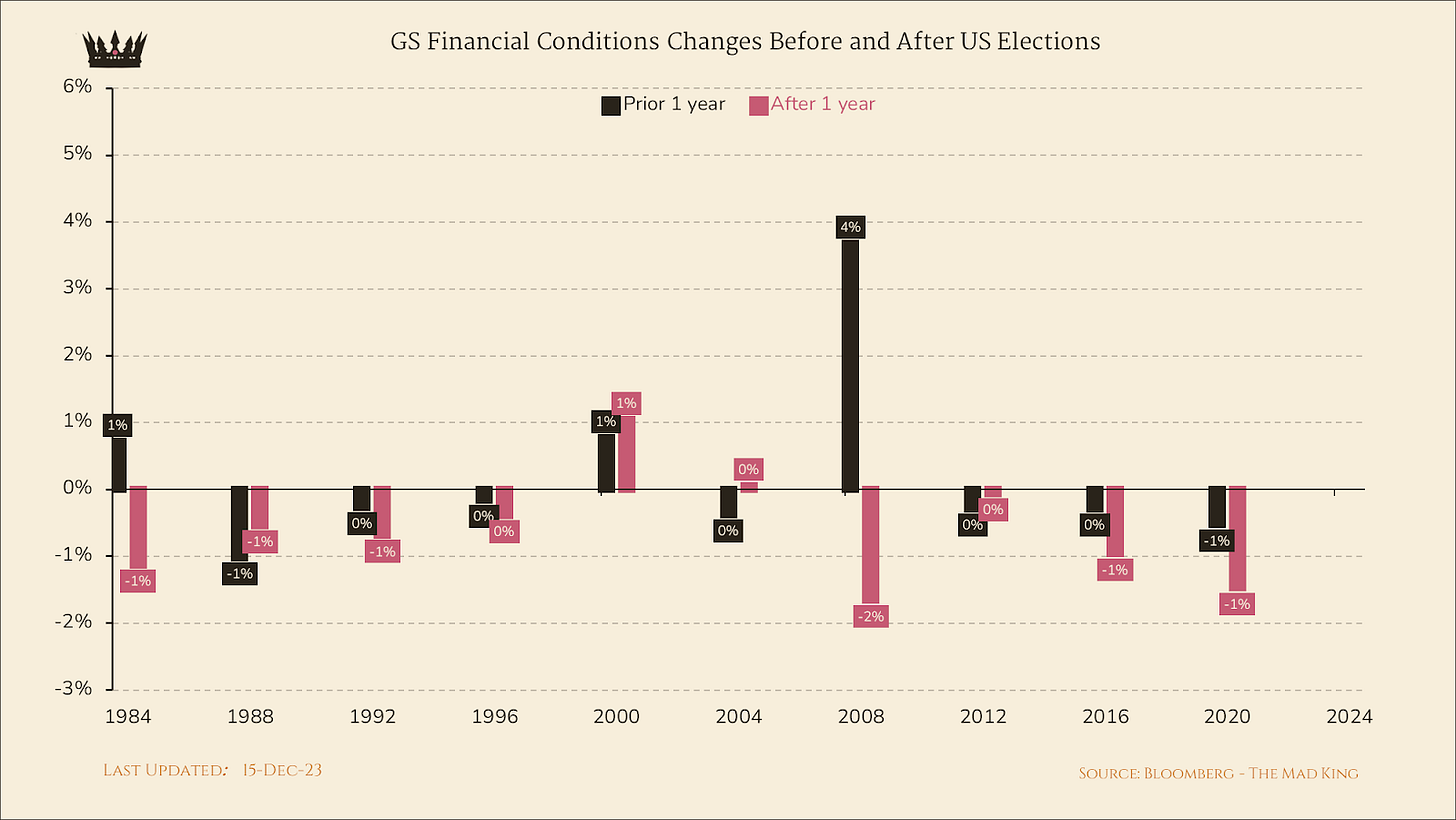

Financial conditions usually improve (negative = improvement)... except when we have a recession not far ahead or happening (2000, 2008).

Durable goods also improve, outside of a recession. But we know that there is an excess to clear.

Here is the excess I am talking about…

Tax receipts contract only during a recession…

Ditto for US GDP…

This one is an interesting way to look at unemployment, especially as it is usually the last domino to fall before a recession.

It is already ticking up, by the way, currently at 7.8%. 25% growth means a 100% chance of a recession.

US leading indicators usually improve, except before a recession. They should pick up shortly if we are to see positive growth before the election.

Right now they are stuck in contraction…

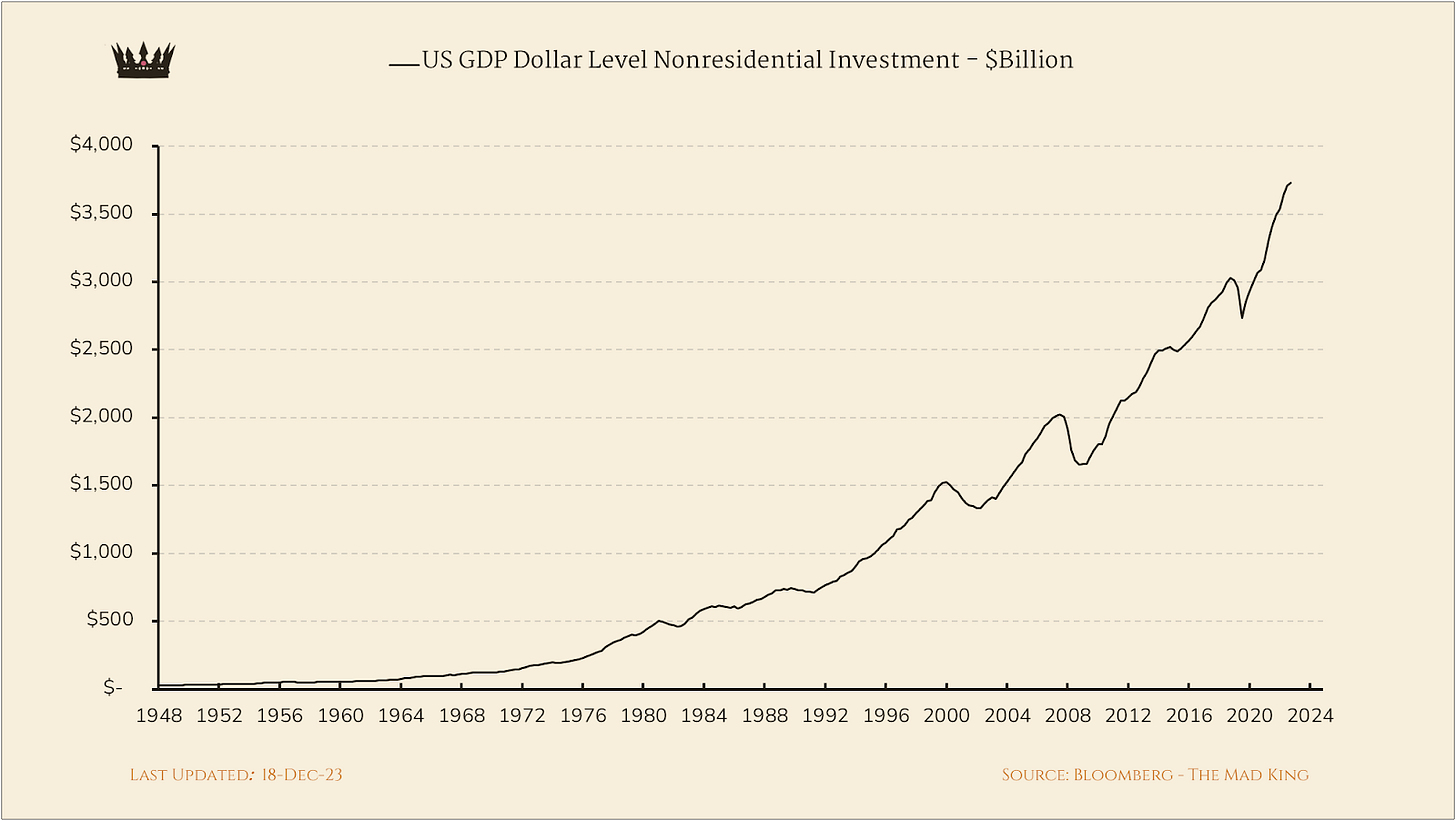

US nonresidential investment is always strong, unless there is a recession around.

But to be fair, it looks like a correction is overdue…

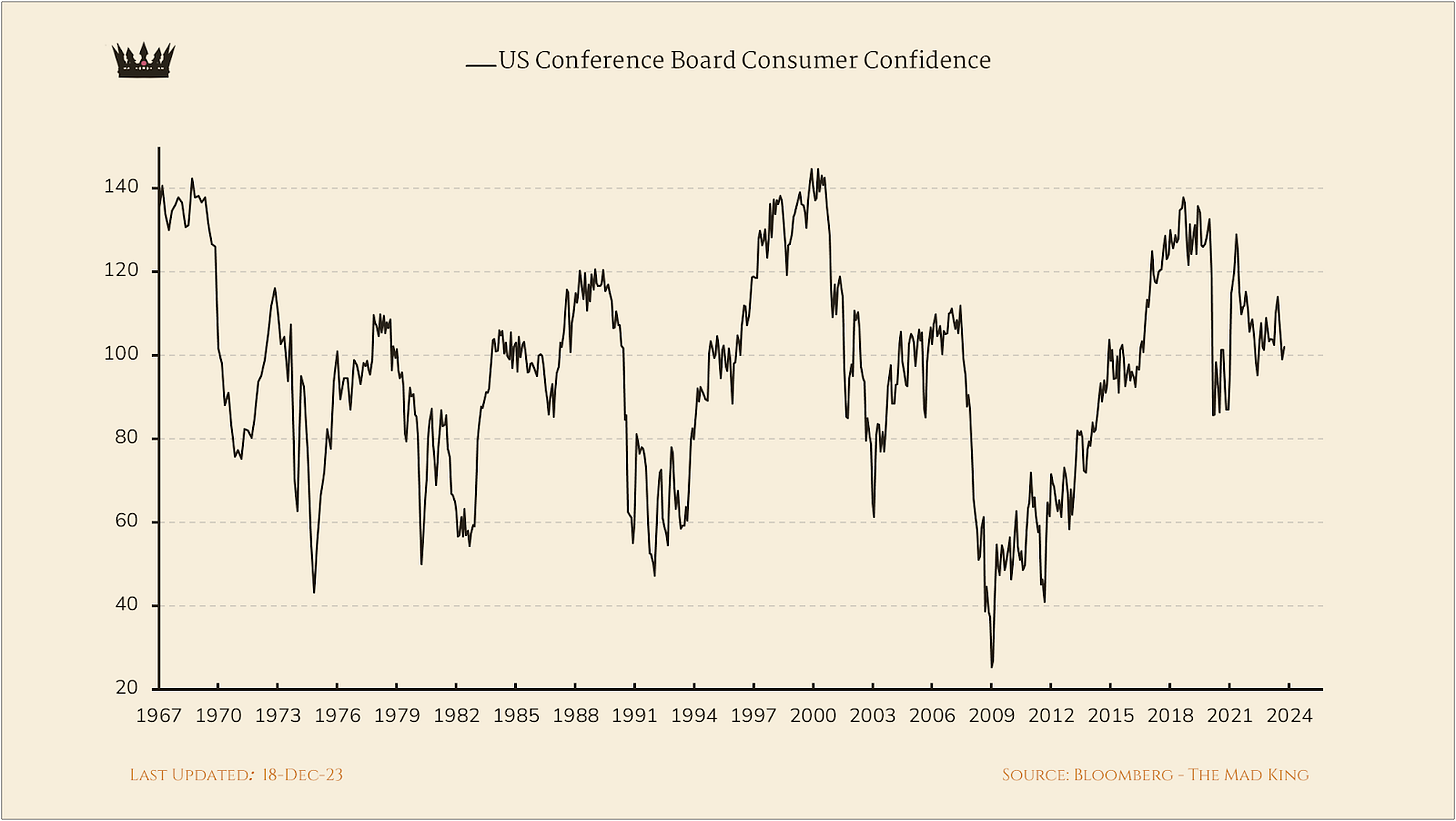

Obviously, consumer confidence will be important ahead of the election. Currently, growth is neutral at 0%...

…but the outright data looks more like it is about to correct than improve.

Markets expect Fed target rates to decline. It will all be about a soft landing and avoiding a recession, at least until November 2024…

Conclusion

Based on the charts I shared today, it appears that a stock market rally could be expected leading up to the US election, with the caveat that a recession would alter this possibility.

The dollar's performance will be a significant factor, potentially initiating changes earlier than might be preferred by the ruling party, if the dollar were to get too strong.

Many economic data for 2024 are projected to show negative growth, providing insights into voter sentiment we might encounter in November.

Additionally, an increase in unemployment will complicate matters for the Federal Reserve. They will need to adeptly handle the easing cycle to ensure a smooth economic downturn, aiming for a soft landing instead of a mild recession.