In the recently published “The King’s Mind 2024” I shared a few key themes to watch closely in 2024. Today I am sharing three (and a bonus) with you.

From now on, I will publish a weekly article every Wednesdays on Substack (starting this week), so please do not hesitate to share our content and spread the word.

#1 – Recession

I'm sceptical about the soft landing narrative. In my view, the US is facing an impending recession that will primarily stem from issues in the housing market and consumer spending, driven by elevated interest rates.

Historically, from 1950 onwards, every recession has seen the stock market shrink, ranging from a 10% decrease in 1980 to a 52% drop in 2008.

The average market correction across the last twelve recessions is 25.5%, with a median of 19.5%. I expect the upcoming recession to be short-lived and not too severe, with a potential maximum correction of around 30%, which is a bit higher than the average.

If this prediction holds, it would mean the S&P 500 could bottom out around 3300.

There are a lot of signals suggesting the odds favour a recession. Sentiment is overbullish; the market is overbought; VIX and financial conditions are low.

#2 – Volatility – Long

Should a market correction occur, we can anticipate a resurgence in volatility. This would be due largely to the impact of high yields on the economy, which typically has a two-year delay. If historical patterns are any indication, the year 2024 could be marked by significant volatility.

Bankruptcies are also ticking up and would most likely accelerate in the event of a recession. Volatility and bankruptcies would most likely increase in tandem.

#3 – The S&P 500 – Short

This is the vanity trade, and it can be painful if you get your timing wrong; but boy, the S&P 500 chart pattern is something. If the S&P 500 corrects from now and fails to make a new all-time high, it would be forming a perfect double top pattern. (Note that in 2007 the all-time high was made on peak 2.) For the pattern to be confirmed, it will have to break the neckline.

If only there were signs…

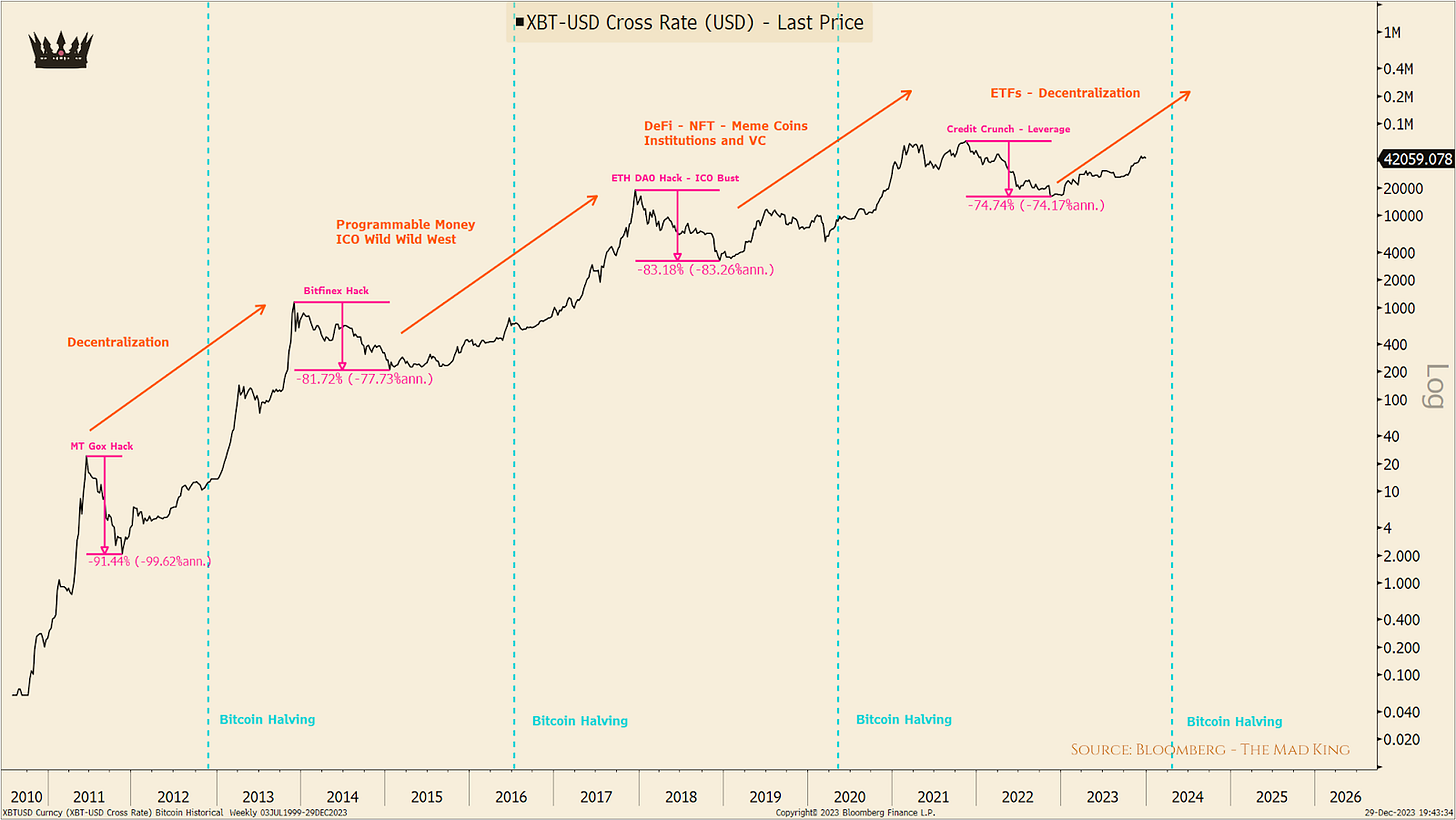

Bonus #1 – Bitcoin – Long

The year 2024 is significant for Bitcoin as it marks a halving event, which historically is a positive indicator for both Bitcoin and the broader cryptocurrency market. However, I believe the rally for this cycle started somewhat prematurely, and I anticipate a correction in Bitcoin's price. This correction is the key signal I am looking out for.

While it's possible that Bitcoin could continue to rally from its current position, I prefer to approach it with caution.

A practical strategy to mitigate risk is to employ dollar-cost averaging (DCA) over a period of 8 to 12 weeks.

Additionally, there's the potential approval of a Bitcoin ETF early in January, though this may already be priced in. The increase in global liquidity generally bodes well for Bitcoin, but there are signs of this trend slowing down.

Investing in high-risk assets like Bitcoin ahead of a recession can be risky. For instance, in 2018, during the Federal Reserve's rate cuts – our only comparable historical instance – Bitcoin experienced a 38% correction.

Given Bitcoin's volatility, I am inclined to wait for a more favorable setup before re-entering the market, but I do believe that Bitcoin’s price will be higher at the end of the year.

This is it for today, see you next week.

Wow .. 3,300 on the S&P ... that's just above the pre-covid peaks. seems like a good level to restart a bull run.